change in net working capital formula dcf

The screenshot below introduces you to the file and the assumptions. So in your example if nothing changed except your AR increased by 10 bucks yes your Net Working Capital is higher.

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

Top 3 Pitfalls Of Discounted Cash Flow Analysis

Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

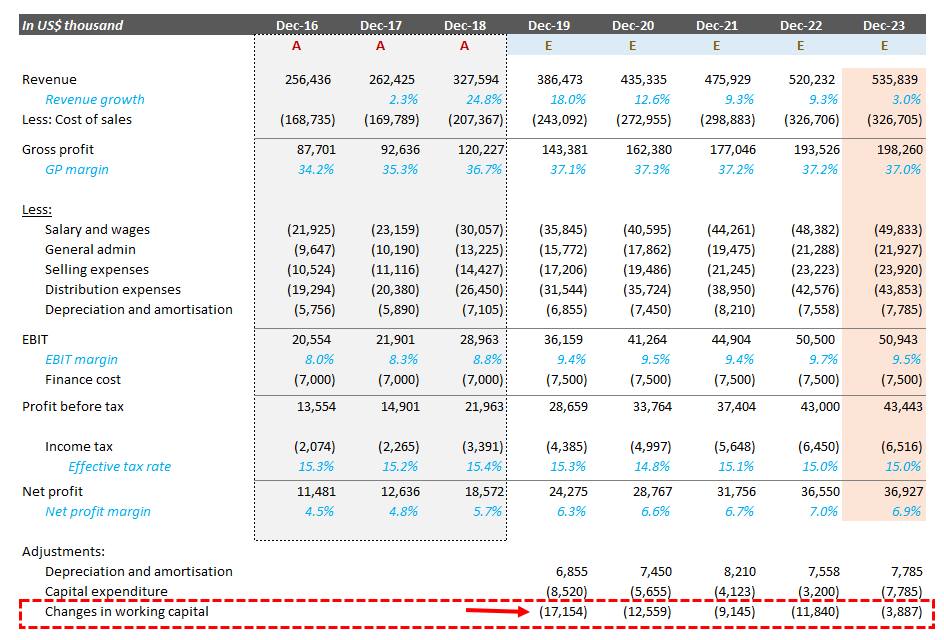

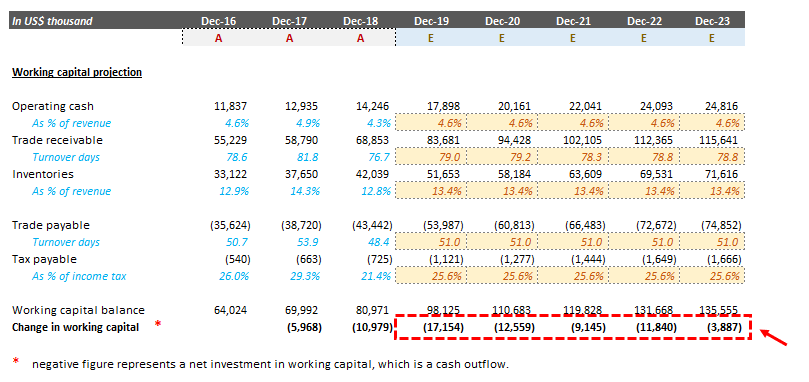

. Working capital ratios between 12 and 20 indicate a company is making. Change in Working Capital is a cash flow item and it is always better and easier to use the numbers from the cash flow statement as I showed above in the screenshot. However to check the change in cash you subtract the increase in NWC for.

For year 2020 the net working capital is 10000 20000 Less 10000. Change in Working Capital Summary. Calculate the working capital in year 2 from the balance sheet subtract to get the change But there is a formula which Ive provided in the next section.

The balance sheet is a snapshot of the companys assets liabilities and shareholders equity at a moment in time such as the end of a quarter or. It means Company A would have to find. Change in working capital formula dcf.

A working capital ratio of less than one means a company isnt generating enough cash to pay down the debts due in the coming year. Working capital ratios between 12 and 20 indicate a company is making effective use of its assets. It still counts as cash that is tied into running the day to day operations of the business.

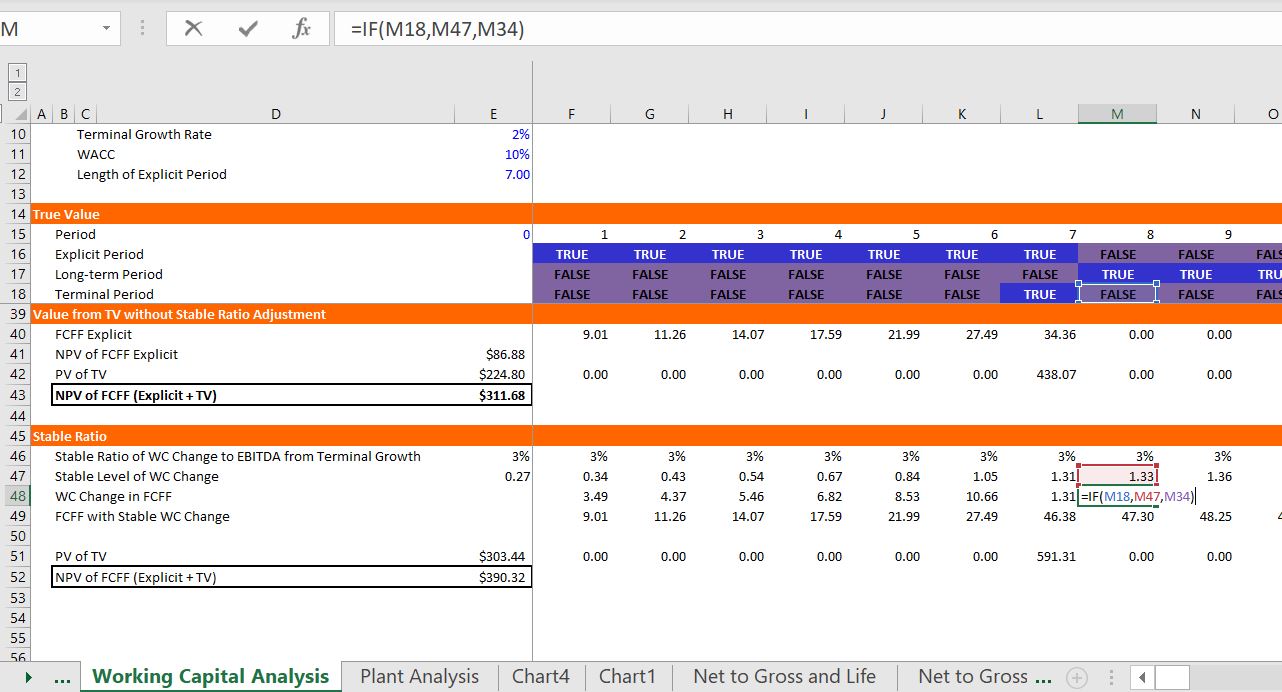

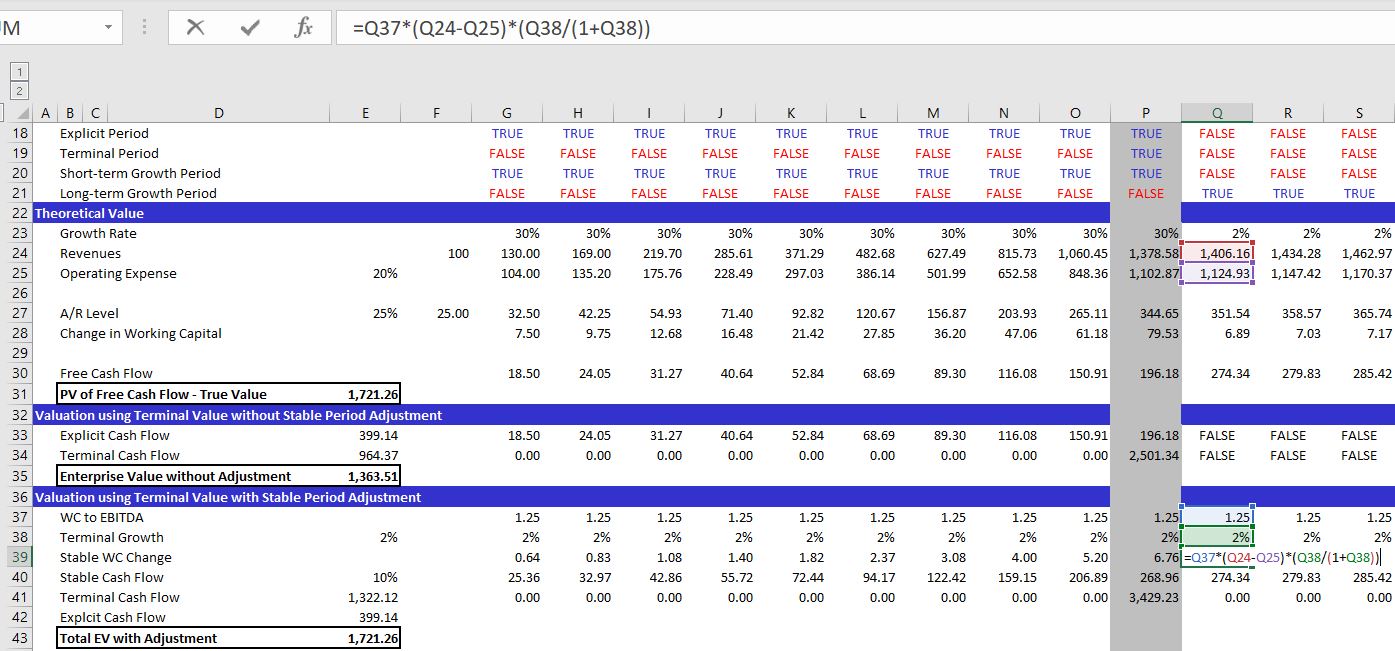

Stable WC Change WCEBITDA EBITDA t terminal growth 1terminal growth. AP accounts payable. In parallel its vital to note that the term working capital on the Cash Flow Statement inherently implies non-cash working capital because the goal of the statement itself is to arrive at a cash balance using non-cash accounts from the income statement and balance sheet.

So if you now have an increase in net working capital of say 10 why would you subtract this to get your free cash flow. The net working capital metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand. A working capital ratio of less than one means a company isnt generating enough cash to pay down the debts due in the coming year.

On the right side of the screenshot you can see the magnitude of the error. When using the formula to understand cash changes. CEO Buys after Price Drop 20.

For cash purposes you need to think about the change in Working Capital. FCF EBIT1-Tax Rate Depreciation and Amortization Capital Expenditures Increases in Net Working Capital NWC If you have an increase in net working capital you have more current assets than liabilities than you did in the previous period. Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should.

Thus the formula for changes in non-cash working capital is. This depends on the difference between explicit period growth which is very high in the example and the terminal growth. How do you project changes in net working capital NWC when building your DCF and calculating free cash flow.

For the year 2019 the net working capital was 7000 15000 Less 8000. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable. Since the change in working capital is positive you add it back to.

In this video I cover the different ratios tha. In other words it is calculated as net working capital minus cash. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or.

The most common items that impact the formula on a simple balance sheet are accounts receivable inventory and accounts payable. Now changes in net working capital are 3000 10000 Less 7000. In this case the change is positive or the current working capital is more than the last year.

You should exclude cash cash equivs. The working capital formula is. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current Operational Assets Current Operational Liabilities.

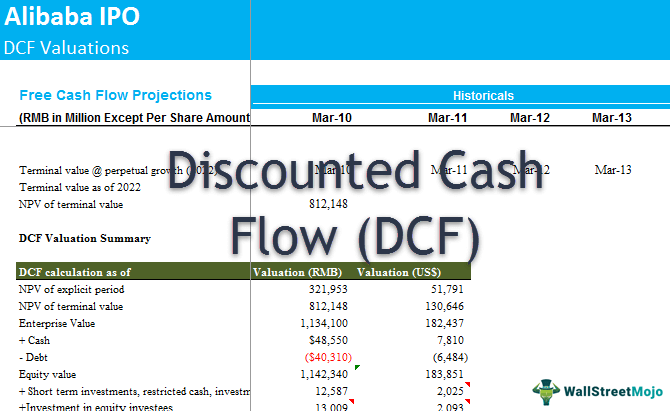

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Working Capital Video Tutorial W Excel Download

Dcf Model Training Free Guide Financial Edge

Discounted Cash Flow Analysis Street Of Walls

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Training Modular Financial Modeling Ii Dcf Valuations Equity Dcf Valuation Terminal Value Modano

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Working Capital Video Tutorial W Excel Download

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance